Calendar Call Spread – Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . This article will focus on the Heating Oil calendar spread. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT .

Calendar Call Spread

Source : www.fidelity.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

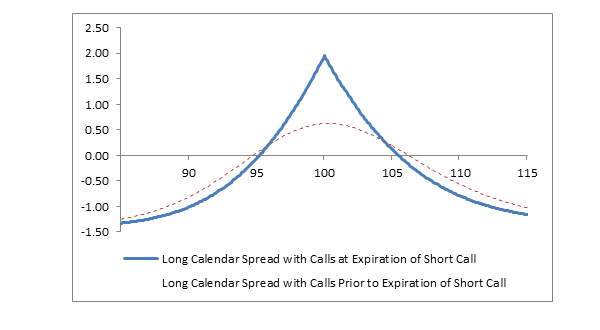

Long Calendar Spreads for Beginner Options Traders projectfinance

Source : www.projectfinance.com

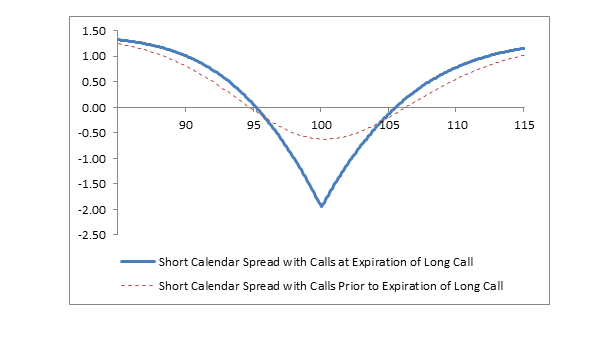

Short Calendar Spread with Calls Fidelity

Source : www.fidelity.com

options Understanding the visual representation of a Calendar

Source : money.stackexchange.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Short Calendar Call Spread | Learn Options Trading

Source : marketchameleon.com

Calendar Call: Definition, Purpose, Advantages, and Disadvantages

Source : www.strike.money

Long Calendar Spreads Unofficed

Source : unofficed.com

Calendar Call Spread Long Calendar Spread with Calls Fidelity: The outlook for Nifty Next 50 is positive, with support levels at 65,770 and 58,420. Considering the limited trading history, the bias remains positive. A suggested strategy involves buying a Nifty . A bid-ask spread is the amount by which the ask price exceeds the bid price for an asset in the market. The bid-ask spread is essentially the difference between the highest price that a buyer is .